沙特阿拉伯可能会在美国石油行业崩溃之前倒下

Saudi Arabia may go broke before the US oil industry buckles

If the oil futures market is correct, Saudi Arabia will start running into trouble within two years. It will be in existential crisis by the end of the decade.

如果石油期货市场是对的,那么沙特阿拉伯将会在两年之内开始陷入麻烦。这个国家将会在这个十年的尾声时陷入一场生存危机。

The contract price of US crude oil for delivery in December 2020 is currently $62.05, implying a drastic change in the economic landscape for the Middle East and the petro-rentier states.

目前2020年12月交付的美国原油期货价格是每桶62.05美元,这个价格体现了中东地区和石油租利国家经济版图的一场剧变。

The Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market and drive out rivals, boosting their own output to 10.6m barrels a day (b/d) into the teeth of the downturn.

沙特人在去年11月【译注:本文作于2015年,此处指2014年11月】开始了一场豪赌,他们停止了对石油价格的支撑,转而选择在市场上倾销以挤出竞争对手,他们在市场急转直下的时候将自己的原油产量提升到了每日106万桶。

Bank of America says OPEC is now “effectively dissolved”. The cartel might as well shut down its offices in Vienna to save money.

美国银行认为OPEC目前“实际上已经解体了”。这个垄断联盟也许会关闭它在维也纳的办公室以节省资金。

If the aim was to choke the US shale industry, the Saudis have misjudged badly, just as they misjudged the growing shale threat at every stage for eight years. “It is becoming apparent that non-OPEC producers are not as responsive to low oil prices as had been thought, at least in the short-run,” said the Saudi central bank in its latest stability report.

如果这么做的目的是打击美国的页岩产业,那么沙特人就犯了个大错,就像他们在过去八年中的每个阶段都错判了成长中的页岩产业的威胁一样。“很显然那些非OPEC产油国对于低油价的反应并不像我们之前所设想的那样剧烈,至少在短期内是这样,”沙特央行在最近的稳定性报告中表示。

“The main impact has been to cut back on developmental drilling of new oil wells, rather than slowing the flow of oil from existing wells. This requires more patience,” it said.

这份报告称:“(这项政策)的主要影响是减少了新油井的开发钻探量,而并非降低现有油井的生产速度。这需要更多的耐心。”

One Saudi expert was blunter. “The policy hasn’t worked and it will never work,” he said.

一位沙特专家则更加直白。“这项政策显然没起作用,而且它也永远起不了作用,”他说。

By causing the oil price to crash, the Saudis and their Gulf allies have certainly killed off prospects for a raft of high-cost ventures in the Russian Arctic, the Gulf of Mexico, the deep waters of the mid-Atlantic, and the Canadian tar sands.

通过让油价崩溃,沙特人和他们的海湾盟友们显然杀死了那些试图在俄罗斯北极地区,墨西哥湾,大西洋中部深海和加拿大油砂中提炼原油的昂贵冒险活动。

Consultants Wood Mackenzie say the major oil and gas companies have shelved 46 large projects, deferring $200bn of investments.

咨询公司Wood Machenzie表示,大型油气公司们已经将46个大型项目束之高阁,这推迟了大约2000亿美元的投资支出。

The problem for the Saudis is that US shale frackers are not high-cost. They are mostly mid-cost, and as I reported from the CERAWeek energy forum in Houston, experts at IHS think shale companies may be able to shave those costs by 45pc this year – and not only by switching tactically to high-yielding wells.

沙特人所面临的问题是,美国的页岩油气生产商们的成本并不高。正如我在休斯顿举办的CERAWeek能源论坛上所报告的,这些公司中的大多数成本都处于适中的水平,IHS公司的专家们认为这些页岩油气公司也许能在今年将这些成本削减45个百分点——而这并不仅是靠战术性地转向那些高产的油井来做到的。

Advanced pad drilling techniques allow frackers to launch five or ten wells in different directions from the same site. Smart drill-bits with computer chips can seek out cracks in the rock. New dissolvable plugs promise to save $300,000 a well. “We’ve driven down drilling costs by 50pc, and we can see another 30pc ahead,” said John Hess, head of the Hess Corporation.

先进的井台批量钻探技术让页岩油业者能在同一处钻探点打出5口或10口不同方向的油井。植入了计算机芯片的智能钻探装置能够自动发现岩层中的裂缝。最新的可溶解油栓技术有望为每口油井节省30万美元的成本。“我们已经将钻探成本降低了百分之五十,而且我们认为目前的成本还有百分之三十的下降空间,”Hess集团总裁John Hess表示。

It was the same story from Scott Sheffield, head of Pioneer Natural Resources. “We have just drilled an 18,000 ft well in 16 days in the Permian Basin. Last year it took 30 days,” he said.

先锋自然资源公司总裁Scott Sheffield也持相同看法。“我们最近在16天内在二叠纪盆地钻出了一口深达一万八千英尺的油井。而在去年,这样的工程还需要花上30天,”他说。

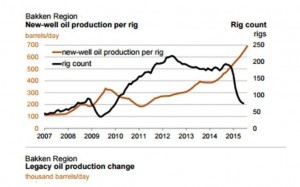

The North American rig-count has dropped to 664 from 1,608 in October but output still rose to a 43-year high of 9.6m b/d June. It has only just begun to roll over. “The freight train of North American tight oil has kept on coming,” said Rex Tillerson, head of Exxon Mobil.

北美工作中的钻机数量从去年十月的1608台下降到了目前的664台,但原油产量却在今年六月升至43年来的最高水平——每日960万桶。而这仅仅只是个开始。“运送北美页岩油的货运火车正源源不断地开来,”埃克森美孚公司总裁Rex Tillerson表示。

He said the resilience of the sister industry of shale gas should be a cautionary warning to those reading too much into the rig-count. Gas prices have collapsed from $8 to $2.78 since 2009, and the number of gas rigs has dropped 1,200 to 209. Yet output has risen by 30pc over that period.

他说,页岩气作为姊妹行业其适应能力应该引起那些过多关注钻机数量的人们的深切警醒。天然气价格已经从2009年的8美元暴跌至目前的2.78美元,而工作中的天然气钻机数量则从当时的1200台降至了目前的209台。但产量却在同一时期上升了超过三十个百分点。

Until now, shale drillers have been cushioned by hedging contracts. The stress test will come over coming months as these expire. But even if scores of over-leveraged wild-catters go bankrupt as funding dries up, it will not do OPEC any good.

直到目前,页岩钻探者们一直受到了对冲合约的保护。而未来的几个月中,随着这些合约到期,真正的压力测试将会到来。但即便这些过度使用杠杆的风险弄潮儿最终因为资金枯竭而破产,OPEC也无法从中得到任何好处。

The wells will still be there. The technology and infrastructure will still be there. Stronger companies will mop up on the cheap, taking over the operations. Once oil climbs back to $60 or even $55 – since the threshold keeps falling – they will crank up production almost instantly.

油井仍然在那里。技术和基础设施也仍然在那里。更加强大的公司将会廉价扫货,并接管他们的生意。一旦油价重新回到每桶60美元甚至55美元——这个阈值正在持续降低——他们将会立即重新启动钻机开始生产。

OPEC now faces a permanent headwind. Each rise in price will be capped by a surge in US output. The only constraint is the scale of US reserves that can be extracted at mid-cost, and these may be bigger than originally supposed, not to mention the parallel possibilities in Argentina and Australia, or the possibility for “clean fracking” in China as plasma pulse technology cuts water needs.

OPEC目前面临着一个挥之不去的困境。每一波油价上涨就会被一波美国原油产量的激增抵消。对此的唯一限制是全美能够以适中成本开采的原油总储量,而这个数字则很可能比人们之前设想的要大,更不用提在阿根廷和澳大利亚的那些类似的可供开采储量,还有中国未来因等离子脉冲技术降低了对水量的需求,实现“清洁开采”的可能性。

Mr Sheffield said the Permian Basin in Texas could alone produce 5-6m b/d in the long-term, more than Saudi Arabia’s giant Ghawar field, the biggest in the world.

Sheffield先生表示,单单是德州的二叠纪盆地在长期内的日产出量就能达到500到600万桶,而这个数字比目前世界上最大的石油产区——沙特阿拉伯的大Ghawar油田的产出还要大。

Saudi Arabia is effectively beached. It relies on oil for 90pc of its budget revenues. There is no other industry to speak of, a full fifty years after the oil bonanza began.

沙特阿拉伯这艘大船实际上已经搁浅了。这个国家预算收入中的90%都依赖石油。而在经历了整整50年的石油大繁荣之后,它并没有发展出任何其它值得一提的产业。

Citizens pay no tax on income, interest, or stock dividends. Subsidized petrol costs twelve cents a litre at the pump. Electricity is given away for 1.3 cents a kilowatt-hour. Spending on patronage exploded after the Arab Spring as the kingdom sought to smother dissent.

该国的国民不需要为他们的收入,利息或者股利交税。在加油站可以用每升12美分的补贴价格购买汽油。每千瓦时的电价仅仅是1.3美分。在“阿拉伯之春”开始之后,由于王室试图平息民间的不满情绪,该国用于收买支持的开支也迅速地增长。

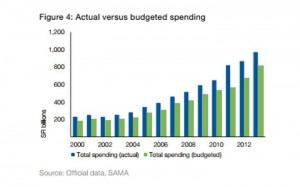

The International Monetary Fund estimates that the budget deficit will reach 20pc of GDP this year, or roughly $140bn. The ‘fiscal break-even price’ is $106.

据国际货币基金组织估计,沙特的财政赤字将在今年占到GDP的20%,也就是大约1400亿美元。而让该国的财政收支达到均衡的油价水平是每桶106美元。

Far from retrenching, King Salman is spraying money around, giving away $32bn in a coronation bonus for all workers and pensioners.

而当今沙特国王萨勒曼却完全没有想要缩减开支的意思,反而四处撒钱,单单是在一次加冕礼上,他就为全国的所有工人和退休者发放了320亿美元的奖金。

He has launched a costly war against the Houthis in Yemen and is engaged in a massive military build-up – entirely reliant on imported weapons – that will propel Saudi Arabia to fifth place in the world defence ranking.

此外,他还对也门的胡塞武装发动了一场代价高昂的战争,并且大肆扩张军备——沙特的军备完全依赖从外国进口武器——这会使沙特的军费开支排到全球第5位。

The Saudi royal family is leading the Sunni cause against a resurgent Iran, battling for dominance in a bitter struggle between Sunni and Shia across the Middle East. “Right now, the Saudis have only one thing on their mind and that is the Iranians. They have a very serious problem. Iranian proxies are running Yemen, Syria, Iraq, and Lebanon,” said Jim Woolsey, the former head of the US Central Intelligence Agency.

沙特王室还需要肩负领导逊尼派对抗东山再起的伊朗的重任,为争夺霸权,整个中东地区的逊尼派和什叶派之间展开了艰苦的斗争。“现在沙特人满脑子都只想着一件事情,那就是来自伊朗人的威胁。他们面临着一个非常严峻的问题,伊朗的代理人目前正控制着也门,叙利亚,伊拉克和黎巴嫩,”美国中央情报局前任局长吉姆·伍尔西表示。

Money began to leak out of Saudi Arabia after the Arab Spring, with net capital outflows reaching 8pc of GDP annually even before the oil price crash. The country has since been burning through its foreign reserves at a vertiginous pace.

在“阿拉伯之春”发生后,资本开始流出沙特阿拉伯,即使在油价崩溃之前,每年资本净流出也占到了GDP的8%。从那时开始,该国的外汇储备就以惊人地速度直线下降。

The reserves peaked at $737bn in August of 2014. They dropped to $672 in May. At current prices they are falling by at least $12bn a month.

沙特的外汇储备在2014年8月达到峰值7370亿美元。而到今年5月,这个数字下降到了6720亿美元。以目前的汇率计算,沙特的外汇储备每月至少会下降120亿美元。【编注:2016年4月 已降至5720亿美元】

Khalid Alsweilem, a former official at the Saudi central bank and now at Harvard University, said the fiscal deficit must be covered almost dollar for dollar by drawing down reserves.

沙特央行的一位前任官员Khalid Alsweilem(目前在哈佛大学担任研究员)表示,沙特政府财政赤字中的几乎每一美元都需要以外汇储备的同等下降为代价来弥补。

The Saudi buffer is not particularly large given the country’s fixed exchange system. Kuwait, Qatar, and Abu Dhabi all have three times greater reserves per capita. “We are much more vulnerable. That is why we are the fourth rated sovereign in the Gulf at AA-. We cannot afford to lose our cushion over the next two years,” he said.

在该国的固定汇率体系之下,留给沙特人的缓冲余地并不是很大。科威特,卡塔尔和阿布扎比所拥有的人均外汇储备是沙特的三倍。“我们相对而言要脆弱得多。这就是为何我们的主权债评级在海湾地区只排第四,评级水平也仅是AA-。在未来两年中,我们承受不起失去外汇储备缓冲的后果,”他说。

Standard & Poor’s lowered its outlook to “negative” in February. “We view Saudi Arabia’s economy as undiversified and vulnerable to a steep and sustained decline in oil prices,” it said.

标普在今年二月将沙特主权债务的评级展望降为“负面”。“我们认为在油价持续急剧下降的过程中,沙特阿拉伯的经济没有多元化,并且十分脆弱,”标普在他们的报告中表示。

Mr Alsweilem wrote in a Harvard report that Saudi Arabia would have an extra trillion of assets by now if it had adopted the Norwegian model of a sovereign wealth fund to recyle the money instead of treating it as a piggy bank for the finance ministry. The report has caused storm in Riyadh.

Alsweilem先生在哈佛大学的一份报告中写道,如果沙特之前采用挪威的主权财富基金模式让外汇储备循环投资,而不是像他们所做的那样仅仅把它当作财政部的一头现金奶牛,目前沙特阿拉伯的资产也许会多出1万亿美元。这份报告在沙特首都利雅得引发了风暴。

“We were lucky before because the oil price recovered in time. But we can’t count on that again,” he said.

“上一次我们很幸运,因为油价适时地恢复了。但是这次我们不能再次指望同样的事情会,”他说。

OPEC have left matters too late, though perhaps there is little they could have done to combat the advances of American technology.

OPEC做出反应时已经太晚了,虽然即使早一些意识到问题,他们也做不了太多事情来对抗美国的技术进步。

In hindsight, it was a strategic error to hold prices so high, for so long, allowing shale frackers – and the solar industry – to come of age. The genie cannot be put back in the bottle.

事后看来,让油价在如此长的时间维持在这么高的位置实际上是一个战略性错误,这样那些页岩油气的勘探者们——还有太阳能产业——就能够成长壮大。一旦被放出来,你就无法再将精灵放回瓶子里了。

The Saudis are now trapped. Even if they could do a deal with Russia and orchestrate a cut in output to boost prices – far from clear – they might merely gain a few more years of high income at the cost of bringing forward more shale production later on.

沙特人如今陷入了困境。即使他们能与俄罗斯达成一致共同减产以支撑油价——虽然这样的愿景目前看来一点也不清晰——这也仅仅能让他们享受多几年的高收入,而这样做的代价却是在未来面临更多的页岩油产出的竞争。

Yet on the current course their reserves may be down to $200bn by the end of 2018. The markets will react long before this, seeing the writing on the wall. Capital flight will accelerate.

而如果当前的趋势维持下去,沙特的外汇储备将在2018年底前降至2000亿美元以下。一旦前景明白无误了,市场会在它成为现实前就早早做出反应。资本外流将会加速。

The government can slash investment spending for a while – as it did in the mid-1980s – but in the end it must face draconian austerity. It cannot afford to prop up Egypt and maintain an exorbitant political patronage machine across the Sunni world.

沙特政府可以在一段时间内削减资本开支——就像它在1980年代中期所做的那样——但最终它将面临严峻的紧缩。沙特将无法负担起支撑埃及政权并在逊尼派穆斯林世界里维持一台昂贵的资助机器的开支。

Social spending is the glue that holds together a medieval Wahhabi regime at a time of fermenting unrest among the Shia minority of the Eastern Province, pin-prick terrorist attacks from ISIS, and blowback from the invasion of Yemen.

庞大的社会开支是将一个仍然处在中世纪状态的瓦哈比政权维系在一起的粘合剂,这个政权正面临着东部省份的什叶少数派中正在发酵的动荡,ISIS时而发动的针刺般的恐怖袭击,还有入侵也门所带来的反作用力。

Diplomatic spending is what underpins the Saudi sphere of influence in a Middle East suffering its own version of Europe’s Thirty Year War, and still reeling from the after-shocks of a crushed democratic revolt.

庞大的外交开支则是维系沙特在中东地区影响力的基础,而目前中东地区正在经历着类似欧洲“三十年战争”般的苦难,同时还在蹒跚地试图爬出镇压民主反抗运动带来的余震。

We may yet find that the US oil industry has greater staying power than the rickety political edifice behind OPEC.

我们也许会发现,虽然同样处在低谷中,但相比OPEC身后的那座虚弱的政治大厦,美国的石油行业其实拥有着更强的生命力。

翻译:Veidt(@Veidt)

校对:Tankman

编辑:辉格@whigzhou